Integrating the Uphold API with Vezgo Crypto API opens possibilities for developers seeking to streamline their cryptocurrency and asset management solutions. Uphold’s robust API offers extensive functionalities, including multi-asset support, real-time price data, and advanced trading capabilities. When combined with Vezgo’s versatile Crypto API, which provides a comprehensive and user-friendly platform for tracking and managing digital assets, the result is a powerful synergy that enhances trading efficiency and portfolio management.

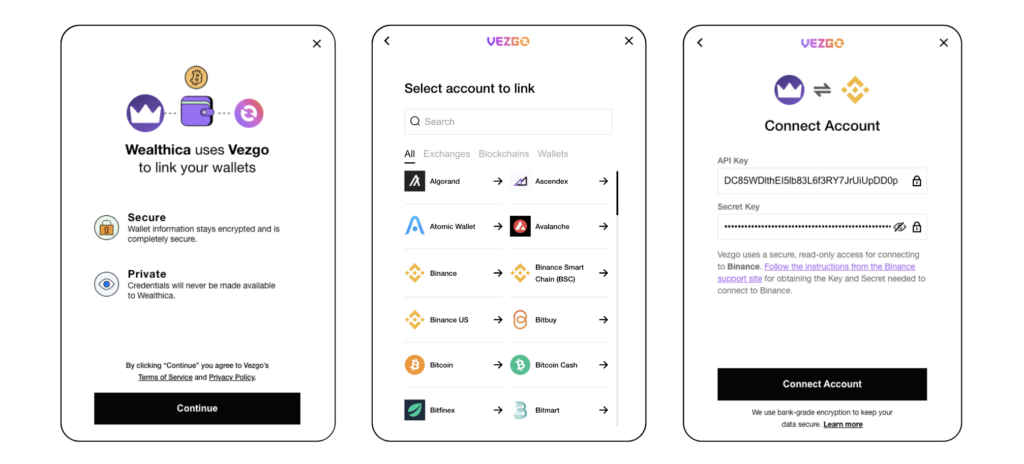

By leveraging a single Vezgo API key for integration with Uphold, developers can benefit from a unified approach to managing and accessing diverse asset classes. This integration simplifies the technical implementation and ensures seamless and secure interactions across both platforms. With Vezgo’s all-in-one solution for portfolio tracking and Uphold’s extensive trading features, developers can deliver a more cohesive and effective user experience, optimizing both functionality and performance in their applications.

Key Features of the Uphold API

The Uphold API caters to developers, traders, and businesses seeking seamless integration into their financial platforms. Here, we delve into the Uphold API’s standout features, each contributing to its status as a versatile and powerful tool in the digital asset space.

1. Multi-Asset Support

The Uphold API excels in its multi-asset support, offering a diverse range of financial assets extending well beyond cryptocurrencies. This API accommodates a broad spectrum of asset classes, including popular digital currencies like Bitcoin and Ethereum and traditional fiat currencies such as the US Dollar, Euro, and Yen. Additionally, it supports precious metals, including gold and silver, and even niche assets like carbon credits, reflecting the growing importance of environmental considerations in financial markets. This expansive support allows users to seamlessly manage and trade across various asset types within a single platform.

The API’s ability to facilitate transactions and portfolio management across such a broad asset spectrum is particularly advantageous for users seeking to diversify their investments and integrate multiple financial instruments into their strategies. By bridging the gap between digital and traditional assets, the Uphold API provides a comprehensive solution that caters to the evolving needs of modern investors, offering both flexibility and depth in asset management.

2. Secure Authentication

The Uphold API ensures the highest level of transaction security through its adherence to OAuth 2.0 standards, a robust framework that guarantees secure authorization and access control. Uphold’s Web Application Flow is particularly well-suited for web applications that need to retrieve detailed information from a user’s Uphold account or perform actions on their behalf, providing a seamless and secure user experience. This flow employs OAuth 2.0’s authorization code grant, which requires user consent before granting access, enhancing security and privacy.

Conversely, the Client Credentials Flow caters to backend integrations that operate independently of user accounts, offering a secure means to access API resources without needing individual user authentication. This flow utilizes client credentials to authenticate, making it ideal for server-to-server communications where user-specific access is not required. Together, these OAuth 2.0-compliant flows ensure that Uphold’s API maintains rigorous security standards, protecting user data and transactional integrity while accommodating various application needs.

3. Real-Time Data With Tickers

The Uphold API’s tickers feature is essential for accessing and analyzing real-time market data, offering a detailed snapshot of price movements and trading activity across various asset pairs. Each ticker encompasses a range of vital information, including the latest market price, bid and ask prices, and trading volume for assets such as cryptocurrencies, fiat currencies, and precious metals. By providing this granular data, tickers allow users to monitor fluctuations in real-time, which is crucial for executing informed trading strategies and making swift decisions based on current market conditions.

The ticker feature also includes historical data points, enabling users to observe trends and patterns over time. This functionality supports technical analysis by allowing traders to examine price trajectories and market behavior. Additionally, tickers provide insights into liquidity through bid and ask spreads, helping traders assess the market depth and potential slippage. By integrating these real-time and historical insights, the Uphold API’s tickers empower traders and investors with effective decision-making and strategic planning tools. This comprehensive data offering enhances market transparency and equips users with the precise information required to navigate the complexities of financial markets with greater confidence and accuracy.

4. Flexible Integration

The Uphold API enhances flexibility by incorporating webhooks, pivotal in real-time communication between Uphold’s platform and integrated applications. Webhooks act as a mechanism for pushing notifications to a specified URL endpoint whenever predefined events occur, such as completed transactions, account status changes, or asset holdings updates. This real-time push model contrasts with traditional polling methods, where applications repeatedly request data to check for updates. Instead, webhooks immediately alert the application to changes, enabling swift responses and reducing the need for continuous API requests.

Uphold’s webhooks are highly customizable, allowing developers to specify the types of events they wish to be notified about and tailor their application’s behavior accordingly. This flexibility ensures that applications react promptly to critical events, such as executing automated trading strategies or updating user interfaces with the latest information. For instance, upon receiving a webhook notification about a completed transaction, an application can instantly update the user’s transaction history and reflect changes in their account balance. By leveraging webhooks, developers can create more responsive and efficient applications, enhancing user experience and operational efficiency while maintaining a high degree of real-time interaction with the Uphold platform.

5. Rate Limit

The Uphold API’s rate limiting is a crucial feature designed to maintain the platform’s performance and reliability by regulating the volume of user requests. For example, the global rate limit allows up to 250 requests per IP address within one minute. This cap helps to manage the load on Uphold’s servers, preventing any single user or application from overwhelming the system with excessive requests. By enforcing these limits, Uphold ensures that the API remains responsive and stable, even during peak usage.

This rate-limiting mechanism serves multiple purposes: it protects the API infrastructure from potential abuse, minimizes the risk of system overload, and ensures a fair distribution of resources among all users. It also aids in preventing abuse scenarios, such as denial-of-service attacks, where a flood of requests could degrade the quality of service for others. For developers, understanding these limits is essential for designing applications that can gracefully handle rate limits by implementing strategies such as request queuing or retry mechanisms. Overall, Uphold’s rate limiting enhances the API’s reliability and efficiency and ensures a balanced and equitable experience for all users, fostering a stable and secure trading environment.

6. Card Concept

The Uphold API employs the innovative concept of a “card” as a dynamic store of value, simplifying and stabilizing the management of diverse assets. Each card is designated by a specific currency or store of value and is automatically assigned one or more addresses to which users can send value. This setup allows multiple cards for the same currency, catering to various needs and scenarios. When value flows into a card, Uphold automatically converts it to match its denomination, preserving the original value and shielding the recipient from the volatility typically associated with cryptocurrencies.

For example, in the case of Bitcoin, this mechanism ensures that the value received is converted into a stable store of value as determined by the card’s currency, thus protecting recipients from Bitcoin’s inherent price fluctuations. This conversion process maintains the value intact and enables recipients to consolidate and normalize all incoming funds to a single, stable value, regardless of the original asset used for the transaction. By utilizing this card concept, Uphold provides a seamless and reliable way to manage and transact across multiple asset types, ensuring stability and consistency in value handling while accommodating the diverse needs of its users.

7. Sandbox Environment and Support

The Uphold API’s sandbox environment offers developers a valuable and secure space to test and refine their applications before deploying them live. This sandbox environment mimics the Uphold API infrastructure, allowing developers to simulate transactions, access data, and interact with various API endpoints without affecting user accounts or authentic funds. It provides a risk-free platform to experiment with different functionalities, test integration scenarios, and ensure that applications perform as expected under various conditions.

Additionally, Uphold offers robust support for developers working within the sandbox, including comprehensive documentation, detailed API references, and responsive technical assistance. This support ensures developers can efficiently navigate challenges and leverage the sandbox environment to its fullest potential. Uphold facilitates a smoother development process by providing a realistic yet isolated testing environment and dedicated support. This ultimately leads to more reliable and practical applications when transitioning to the live API.

Please note that this list of features is subject to frequent reviews, updates, and modifications. We recommend checking the Uphold API documentation page for the most current information on updates and critical features.

Why Integrate With Vezgo API Instead Of Uphold

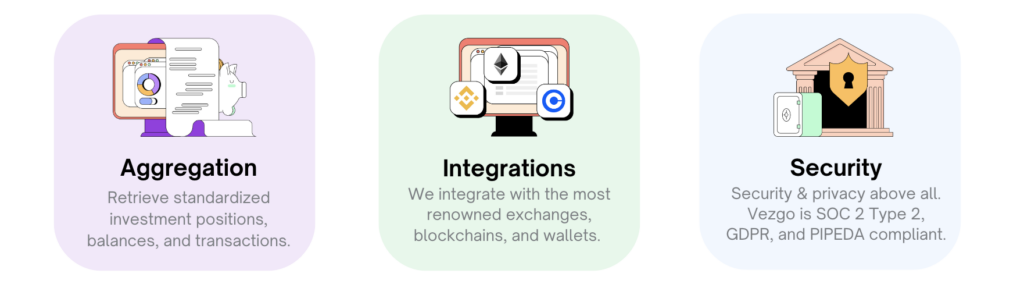

Exploring alternative platforms like Vezgo offers compelling advantages for developers and traders looking for robust integration solutions beyond traditional exchanges. Here are some reasons to consider the Vezgo API for your cryptocurrency integrations:

- Vezgo has a streamlined integration process that simplifies the connection between applications and cryptocurrency markets. Unlike direct exchange APIs, which often involve managing multiple endpoints and dealing with complexities, Vezgo provides a unified API interface consolidating access to various exchanges. This approach reduces development time, minimizes maintenance challenges, and speeds up the deployment of new trading applications and strategies.

- Additionally, Vezgo emphasizes data security with rigorous measures, including SOC 2 Type 2 compliance and AES256 encryption. These certifications protect sensitive user information and transactional data from unauthorized access and breaches. By adhering to top industry security standards, Vezgo ensures regulatory compliance and builds trust among users, particularly in the critical area of digital asset trading.

- Furthermore, the Vezgo API appeals to developers because of its extensive coverage of the cryptocurrency ecosystem. Vezgo continually integrates new exchanges, wallets, and protocols, keeping users up-to-date with the latest developments in crypto. This proactive approach allows developers to stay informed about the rapid changes in the cryptocurrency landscape, enabling them to create advanced trading experiences that boost user engagement and satisfaction.

Vezgo The Crypto API

The Vezgo API stands out for its reliability and efficiency in cryptocurrency integrations. It provides standardized data that ensures consistent and dependable information across various platforms. By upholding rigorous data standards, Vezgo gives developers a solid foundation to create innovative solutions and confidently improve their products, knowing their data is always accurate and trustworthy.

A notable feature of the Vezgo API is its ability to connect seamlessly with over 300 Centralized Exchange (CEX) platforms, blockchains, and wallets using just a single API key. This streamlined approach simplifies the integration process, making it much easier for developers to access and utilize a wide range of features. With Vezgo, developers can tap into the full potential of multiple platforms without the hassle of managing numerous API keys, which boosts the efficiency and scalability of their projects.

Beyond its smooth integration capabilities, Vezgo prioritizes security, offering robust encryption protocols. These measures ensure that user data is well-protected against threats and breaches, reassuring developers and users. With Vezgo’s top-notch security standards, developers can concentrate on building innovative solutions without worrying about data integrity or user privacy.

They can also test their applications using the demo sandbox before going live. Vezgo’s solid reputation for reliability and security has attracted significant clients like Merlin Investor and Softledger, further establishing its role as a leading provider of Crypto API solutions. As demand for secure, reliable APIs grows, Vezgo continues to lead the way, helping developers fully unlock the potential of the crypto market with confidence.

Vezgo’s Uphold API Integration

Developers using the Vezgo API enjoy the convenience of accessing a range of functionalities, such as real-time data, order execution, and account information, all from a single interface that includes prominent platforms like Uphold. This integration eliminates the need for developers to deal with different API implementations for each exchange.

Vezgo’s dedication to providing a unified and flexible gateway to various exchange features makes it a valuable tool for developers seeking solutions beyond Uphold’s constraints. For more details on how Vezgo integrates with the Uphold API, check out our list of integrations and select Uphold for additional information.

About Uphold

Founded in 2014, Uphold has established itself as a prominent player in the digital finance landscape with a mission to provide a seamless and versatile platform for managing various forms of value. Known initially as Bitreserve, the company rebranded to Uphold in 2015, reflecting its broader vision beyond cryptocurrency. The company’s inception was driven by a desire to simplify the complexities of digital asset management, making it accessible to a broader audience through innovative technology and user-friendly services. Over the years, Uphold has evolved, integrating more features and expanding its offerings to meet the growing demands of the financial sector.

Uphold operates out of its headquarters in London, United Kingdom, strategically positioning itself in a global financial hub. This location supports its expansive international reach and aligns with its commitment to providing a secure and compliant platform for users worldwide. The company’s global footprint extends to numerous countries, where it delivers its services focusing on regulatory adherence and financial stability. Uphold’s presence in such a critical financial center underscores its dedication to maintaining a high standard of service and innovation.

Uphold offers a comprehensive range of services designed to address the diverse needs of modern financial management. The platform supports multiple asset types, including cryptocurrencies, fiat currencies, precious metals, and carbon credits. Its services include secure transactions, real-time price data, and advanced trading features, all accessible through an intuitive API. Uphold’s commitment to flexibility and security is evident in its provision of a multi-asset environment and robust API integrations, catering to individual users and institutional clients. By leveraging these services, Uphold facilitates a streamlined and integrated approach to managing digital and traditional assets, enhancing financial interactions and investment opportunities.

Leave a Reply