In recent years, Initial Coin Offerings (ICOs) have emerged as a disruptive force in the world of finance, revolutionizing the way startups raise capital and investors participate in early-stage projects. With the advent of blockchain technology and cryptocurrencies, ICOs have provided entrepreneurs with an alternative fundraising mechanism while granting investors unprecedented access to innovative projects. In this comprehensive analysis, we delve into the intricacies of ICOs, exploring their origins, mechanics, regulatory landscape, and, most importantly, associated risks and rewards. So, let us dive right in.

What is an ICO?

At its essence, an ICO is a fundraising method used by blockchain-based projects to raise capital by issuing digital tokens or coins to investors. These tokens, often based on a standard such as Ethereum’s ERC-20, represent a form of ownership or utility within the project’s ecosystem. Unlike traditional fundraising methods such as venture capital or initial public offerings (IPOs), ICOs typically bypass intermediaries, allowing startups to raise funds directly from a global pool of investors. So, how does an ICO function, and what does it involve?

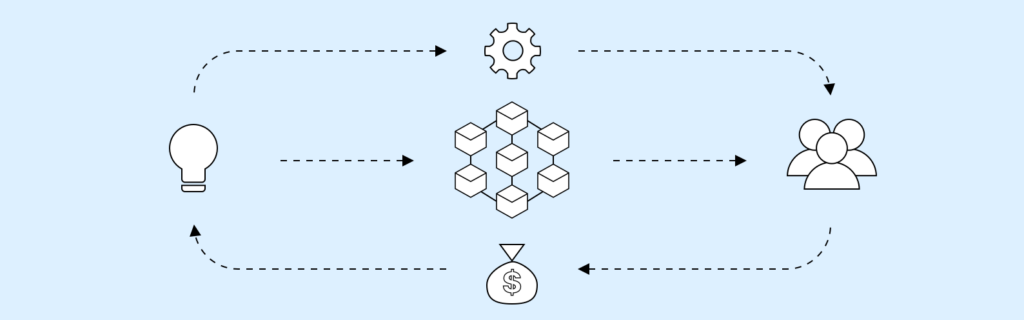

The Framework of an ICO

Conducting an Initial Coin Offering typically follows a structured framework. The following are the components of an ICO and how it functions.

1. Whitepaper

The project team publishes a whitepaper outlining the details of the proposed venture, including its mission, technology stack, tokenomics, and roadmap. The whitepaper serves as a blueprint for potential investors, providing insights into the project’s vision and objectives.

2. Token Sale

During the token sale phase, investors can purchase the project’s tokens using cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH). The sale may be conducted through a dedicated website or platform, with investors sending their contributions to a specified wallet address in exchange for the project’s tokens.

3. Token Distribution

Upon the completion of the ICO, the project team distributes the purchased tokens to investors’ wallets based on the contribution amount and terms specified in the ICO smart contract. Investors now hold tokens that grant them certain rights or privileges within the project’s ecosystem.

4. Listing on Exchanges

After the ICO, project tokens may be listed on cryptocurrency exchanges, where they become tradable assets subject to market forces. The listing provides liquidity to token holders, enabling them to buy, sell, or trade their tokens on secondary markets.

Regulatory Landscape of Initial Coin Offerings (ICOs)

The regulatory landscape surrounding Initial Coin Offerings (ICOs) is a multifaceted domain shaped by diverse regulatory frameworks across jurisdictions. In the wake of the rapid proliferation of ICOs as a fundraising mechanism for blockchain-based projects, regulators worldwide are grappling with the challenge of devising appropriate guidelines to ensure investor protection while fostering innovation. At the heart of regulatory scrutiny lies the classification of Initial Coin Offering tokens and the determination of whether they fall under securities, commodities, or utility tokens. Let us explore these categories further.

Securities Regulation

In many jurisdictions, ICO tokens are subject to securities regulations if they exhibit characteristics similar to traditional securities or investment contracts. For instance, tokens that promise future returns based on the efforts of others or represent ownership stakes in a company may be deemed securities. Consequently, Initial Coin Offering issuers must adhere to stringent regulatory requirements, including registration with regulatory authorities, disclosure obligations, and compliance with investor protection laws. Failure to comply with securities regulations may result in enforcement actions and legal repercussions.

Commodities Regulation

Some jurisdictions classify Initial Coin Offering tokens as commodities subject to regulations governing commodity derivatives or futures contracts. While commodities regulations may offer certain exemptions or relief for ICO issuers, they impose requirements related to trading platforms, anti-money laundering (AML) compliance, and market manipulation prevention. ICO projects operating in these jurisdictions must navigate the complexities of commodities regulations to ensure compliance and mitigate regulatory risks.

Utility Token Exemptions

Certain jurisdictions provide exemptions or safe harbors for ICO tokens that qualify as utility tokens, meaning they have a primary purpose other than investment and provide access to a product or service within the project’s ecosystem. Utility tokens may include tokens used for accessing decentralized applications (dApps), obtaining discounts on platform fees, or participating in governance mechanisms. These exemptions aim to foster innovation and encourage the development of utility-driven blockchain projects while alleviating the regulatory burden on ICO issuers.

Altogether, the regulatory landscape of ICOs has profound implications for stakeholders, influencing investment decisions, project viability, and regulatory compliance efforts. Project teams must prioritize regulatory compliance and transparency to mitigate legal risks and ensure the success of their offerings. Investors must carefully assess the regulatory landscape and project fundamentals before participating in ICOs to avoid potential pitfalls.

Regulatory authorities play a pivotal role in shaping the Initial Coin Offering ecosystem, providing guidance, enforcing regulations, and maintaining market integrity to promote innovation and protect investors. By fostering a transparent, inclusive, and sustainable regulatory framework, stakeholders can navigate the regulatory landscape of ICOs with confidence and contribute to the continued growth and maturation of the blockchain industry.

What are the Risks and Rewards of Initial Coin Offerings (ICOs)?

The allure of ICOs is accompanied by inherent risks and rewards that demand careful consideration by both project teams and investors. In this section, we explore the potential benefits and pitfalls associated with these groundbreaking fundraising events.

Rewards of ICOs

Among the benefits that continue to lure stakeholders into engaging with ICOs are the following.

1. Access to Innovative Projects

One of the primary rewards of participating in ICOs is gaining early access to innovative blockchain projects and decentralized applications (dApps). ICOs empower investors to support visionary entrepreneurs and contribute to the development of cutting-edge technologies that have the potential to disrupt traditional industries. For example, investors participating in an Initial Coin Offering for a decentralized finance (DeFi) platform may gain access to innovative financial products and services that were previously inaccessible.

2. Potential for High Returns

ICOs offer the potential for outsized returns on investment for early backers of successful projects. As promising blockchain projects gain traction and achieve widespread adoption, the value of their tokens may experience exponential growth, resulting in significant financial gains for investors. For instance, investors who participated in the ICO of Ethereum, the second-largest cryptocurrency by market capitalization, realized substantial returns as the platform gained popularity and its native token, Ether (ETH), appreciated in value.

3. Liquidity and Accessibility

Unlike traditional venture capital investments, which often entail lengthy lock-up periods and limited liquidity, ICO tokens are typically tradable on cryptocurrency exchanges shortly after the conclusion of the offering. This liquidity and accessibility empower investors to buy, sell, or trade tokens with ease, facilitating greater market participation and price discovery. Investors can seize investment opportunities and manage their portfolios more dynamically in the liquid and accessible Initial Coin Offering token market.

4. Decentralization and Democratization

ICOs embody the principles of decentralization and democratization by enabling anyone with an internet connection to invest in innovative projects from anywhere in the world. This democratization of access to capital levels the playing field, allowing entrepreneurs from diverse backgrounds to raise funds and pursue their entrepreneurial endeavors. Similarly, investors from all walks of life can participate in ICOs, fostering greater inclusivity and diversity in the global financial landscape.

5. Token Utility and Ecosystem Participation

Many ICO tokens possess intrinsic utility within their respective ecosystems, granting holders access to platform features, products, or services. By acquiring and holding these tokens, investors become stakeholders in the project, with the ability to influence its development and governance through voting mechanisms or staking mechanisms. For example, holders of governance tokens in decentralized autonomous organizations (DAOs) may participate in decision-making processes regarding protocol upgrades or allocation of funds.

Risks of ICOs

Initial Coin Offerings are also plagued with some risks that make it necessary for investors to conduct thorough due diligence and assess the credibility and viability of projects before participating in them. Here are a few risks to consider.

1. Regulatory Uncertainty

One of the foremost risks associated with ICOs is regulatory uncertainty stemming from the evolving regulatory landscape across jurisdictions. Regulators worldwide are grappling with the classification of ICO tokens and the application of existing securities laws to digital assets. Consequently, ICO issuers and investors face legal risks, compliance challenges, and potential regulatory backlash. For instance, the U.S. Securities and Exchange Commission (SEC) has taken enforcement actions against ICOs deemed to have violated securities laws, emphasizing the importance of regulatory compliance.

2. Fraudulent Activities

The decentralized and pseudonymous nature of blockchain technology creates opportunities for fraudulent schemes and scams in the Initial Coin Offering space. Unscrupulous individuals may launch fraudulent ICOs with no intention of delivering on their promises, deceiving investors with false claims and exaggerated projections. Investors must exercise caution and conduct thorough due diligence to distinguish legitimate projects from fraudulent ones. Examples of ICO scams include Ponzi schemes, where early investors are paid returns using funds from new investors, and exit scams, where project founders disappear with investors’ funds after raising capital through an ICO.

3. Market Volatility

The cryptocurrency market is notorious for its extreme volatility, characterized by rapid price fluctuations and unpredictable market dynamics. Following an ICO, the value of the issued tokens may experience wild price swings driven by speculative trading, market sentiment, and external factors such as regulatory announcements or technological developments. Investors are exposed to significant financial risks as the value of their investments could plummet suddenly, resulting in substantial losses.

4. Lack of Transparency

Transparency is paramount in any investment endeavor, yet many ICOs suffer from a lack of transparency regarding their underlying technology, development roadmap, and allocation of funds. Without adequate disclosure and accountability mechanisms, investors are left in the dark regarding the true nature and viability of the project. This opacity increases the likelihood of mismanagement, misallocation of funds, and, ultimately, project failure. Investors should scrutinize whitepapers, review project documentation, and seek clarity on key aspects of the project before committing any funds to an ICO.

5. Technical Risks

Blockchain projects, particularly those launched through ICOs, are susceptible to a myriad of technical risks and challenges. These include but are not limited to security vulnerabilities, smart contract bugs, scalability limitations, and interoperability issues. A single coding error or security flaw could compromise the entire project, leading to catastrophic consequences for investors and stakeholders. Examples of technical failures in Initial Coin Offering projects include hacks resulting in the loss of investor funds, vulnerabilities in smart contracts allowing for exploitation by malicious actors, and delays in project development due to scalability issues.

A Look at Vezgo, the Crypto Data API

Thinking of building a crypto exchange platform or other related services for your users? Vezgo presents a revolutionary solution for developers seeking to create such platforms by offering a comprehensive crypto API that aggregates features and data from over 300 other established and well-grounded exchanges and platforms. With Vezgo’s cutting-edge technology, developers can seamlessly integrate a wide range of functionalities, including real-time market data and portfolio management tools, into their platforms. By leveraging Vezgo’s extensive network of exchange partners, developers can access standardized data from diverse sources, enabling them to offer a rich and competitive platform to their users.

What sets Vezgo apart as the premier choice for crypto integration is its unparalleled commitment to security and reliability. Vezgo’s crypto API adheres to the highest security standards, including SOC2 Type 2 certification, TLS 1.2 encryption, and industry-leading encryption protocols. This ensures that developers and their users can transact with confidence, knowing that their sensitive information and assets are safeguarded against unauthorized access and malicious attacks.

Moreover, Vezgo simplifies the integration process by providing a single API key that grants access to a comprehensive suite of features and functionalities. This eliminates the burden of managing multiple API keys and streamlines the development process, allowing developers to focus on building innovative and engaging experiences for their users. With Vezgo, developers can accelerate time-to-market and deliver a superior platform that meets the evolving needs of the crypto community.

In summary, Vezgo’s crypto API stands out as the best-in-class solution for developers looking to create a crypto platform that offers unparalleled features, data aggregation, and security. By partnering with Vezgo, developers can harness the power of diverse exchanges and platforms, leverage standardized data, and benefit from advanced security measures to build a successful and secure crypto platform. With Vezgo, the future of crypto integration is within reach.

FAQs

Here are the answers to some of the frequently asked questions about Initial Coin Offerings.

Comments (2)

Cryptocurrency Glossary: Must-Know Termssays:

19 May 2024 at 5:33 pm[…] Initial Coin Offering (ICO) is a fundraising method used by cryptocurrency startups to raise capital by issuing digital tokens […]

Crypto Millionaires: Stories of Early Adopters - Vezgosays:

9 June 2024 at 11:39 pm[…] the world’s largest cryptocurrency exchanges by trading volume. He launched Binance through an initial coin offering (ICO), raising $15 million within days. Binance’s unique value proposition—a user-friendly interface, […]