In Q1 of 2023, cybercriminals managed to steal approximately $400 million through 40 separate attacks on cryptocurrency projects according to a report.

How horrible would it be to lose several dollars’ worth of cryptocurrency investments to unprecedented attacks?

As a cryptocurrency investor, the last thing you’d want would be to lose your hard-earned funds. However, such situations still happen, despite the best efforts of individuals and cryptocurrency exchanges.

Crypto insurance provides an alternative buffer to ease the burden of loss when such scenarios happen. In this article, you’ll learn about this budding aspect of the cryptocurrency market and why it’s essential.

The Ultimate Risk Inherent In Crypto Investing?

Before proceeding to the details of crypto insurance, it’s crucial to highlight the ultimate risk investors face regarding the safety of their digital assets.

Crypto insurance is necessary because of the sheer number of cyberattacks that investors and exchange platforms face annually.

No one is safe from the onslaught, not even the big platforms like Binance, with their enormous budgets for cybersecurity. These malicious elements launch attacks with ransomware, crypto-jacking, crypto exchange hacks, and so on.

For instance, the Ronin Network suffered a significant hack in late 2021, with hackers capitalizing on security vulnerabilities to loot over $600 million worth of digital assets. Big name cryptocurrency exchange platforms like KuCoin and Binance have not been exempt, with around $281 million and $40 million worth of assets stolen in separate occurrences.

In fact, 2022 was a massive year for crypto hackers. The biggest ever. That year, the total recorded amount lost to hackers alone was $3.8 billion!

What are the most common crypto hacks?

Hackers and thieves are extremely creative and use different ways to steal cryptocurrency. It’s important to know their techniques in order to be prepared and protect yourself.

- Phishing Attacks:

- Hackers create fake websites or emails that resemble legitimate ones to deceive users into revealing their private keys or login credentials.

- Example: A user receives an email claiming to be from their crypto exchange, asking for login details. The fake site captures the information, giving hackers access to the account.

- Malware Infections:

- Malicious software infects users’ devices, allowing hackers to steal keys and access wallets.

- Example: Users unknowingly download malware from an untrusted source, which logs keystrokes and extracts wallet passwords.

- Exchange Vulnerabilities:

- Weak security practices on cryptocurrency exchanges make them vulnerable to breaches, enabling hackers to steal users’ funds.

- Example: A crypto exchange fails to implement adequate security measures, leading to a breach where hackers steal users’ assets.

- Social Engineering:

- Hackers manipulate individuals into revealing sensitive information or performing actions that compromise their crypto holdings.

- Example: Impersonating a trustworthy entity, a hacker tricks a user into sharing their wallet’s private key.

- SIM-Swapping:

- Hackers convince phone carriers to transfer a victim’s phone number to a new SIM card, granting access to 2FA codes.

- Example: A hacker convinces a carrier employee to transfer a victim’s number to their own SIM card, enabling access to 2FA codes for account access.

- This is what happened to Ethereum’s founder, Vitalik Buterin in 2023. A total of $691,000 was siphoned from individuals’ wallets, with non-fungible tokens (NFTs) constituting 73% of the total value.

- Ponzi Schemes and Scams:

- Fraudulent investment schemes promise unrealistically high returns, leading users to invest and lose their assets.

- Example: A fake crypto project guarantees investors exorbitant profits but vanishes after collecting a significant amount of funds.

- Initial Coin Offering (ICO) Scams:

- Fake ICOs lure investors, collect funds, and disappear without delivering any product or service.

- Example: A fraudulent ICO promotes a non-existent blockchain project, raises funds from investors, and absconds with the capital.

- Rug Pulls in DeFi:

- Developers of DeFi projects create fraudulent tokens or protocols, leading to sudden value collapses.

- Example: A DeFi project creator launches a token, attracts investments, then pulls the liquidity, causing token values to plummet.

- Unsecure Wallets:

- Using insecure or poorly managed wallets exposes users to theft when private keys are compromised.

- Example: A user stores their private key on an easily accessible digital note, and someone discovers it, gaining control of the wallet.

- Crypto Pump and Dump:

- Manipulating the price of a cryptocurrency to artificially inflate it and then selling off, leaving others with worthless assets.

- Example: A group of traders artificially inflates the price of a low-cap crypto coin, luring investors to buy before selling off their holdings at a profit, causing a price crash.

- Smart Contract Exploits:

- Identifying vulnerabilities in smart contracts and exploiting them to drain funds from DApps.

- Example: A hacker exploits a coding flaw in a DeFi smart contract, draining users’ funds from the protocol.

- Insider Threats:

- Employees or individuals with access to crypto platforms misuse their authority to steal funds or data.

- Example: An employee at a crypto exchange abuses their access privileges to transfer customer funds to a personal account.

Is crypto insurance beginning to look appealing to you yet?

So, What is Crypto Insurance?

Insurance covers for the loss of life and property, and cryptocurrency insurance is thus applicable. Simply put, crypto insurance is protection against the loss of cryptocurrency assets from cyberattacks.

Insurance of any sort is a curative measure. However, crypto insurance is both a curative and preventive measure in blockchain technology. Crypto insurance covers the damage if you have suffered unfortunate losses in exchange-wide or personal wallet attacks.

The insurance policies offer exchange-based and individual protection, with special encryption software designed to prevent the loss of digital assets from human error or theft.

Cyberattacks often covered include phishing, device theft, Trojan software, brute force attack, malware, etc.

However, there are some limitations. Most crypto insurance policies are not comprehensive, as investors usually have several assets in their portfolio, each with a high degree of risk.

A Glimpse of the Wider Cryptocurrency Insurance Industry

It’s no surprise that the most significant niche in this fast-growing crypto insurance industry involves insuring crypto exchange platforms.

Many brokerages have lost credibility, with some suffering ruination after successful cyber attacks. FTX comes to mind here. In these events, users lost their funds without a means of recovering them.

Since the cryptocurrency market is largely unregulated worldwide, investing is a highly risky business. In short, if you lose your funds on an exchange platform, you’re on your own. You have no legal grounds to sue and are entirely at the mercy of the platform’s willingness and capacity to recover the lost assets.

Crypto insurance for exchanges

Today, many exchanges are taking steps to insure their platforms. A small portion of transaction fees goes toward a collective fund that activates in cases of hacks.

Alternatively, some exchanges even outsource the insurance to specialist crypto insurance organizations.

Crypto insurance for individual investors

Crypto insurance for individual investors is a relatively new but growing industry designed to protect cryptocurrency investors from various risks and losses associated with their digital assets.

Here are some key points about crypto insurance for individual investors:

Purpose: Crypto insurance aims to provide peace of mind to investors who hold significant amounts of cryptocurrencies, safeguarding their investments against theft, hacks, fraud, and other risks.

Coverage: Crypto insurance policies typically cover a range of potential losses, including:

- Hacks and breaches of cryptocurrency exchanges or wallet providers.

- Loss of private keys or access credentials.

- Unauthorized transactions.

- Errors or omissions by service providers.

- Regulatory and compliance issues.

Types of Policies:

- Custodial Wallet Insurance: Some cryptocurrency exchanges and custodial wallet providers offer insurance to their users, covering losses incurred while the assets are held on their platform.

- Personal Wallet Insurance: A growing number of insurers offer personal cryptocurrency wallet insurance, which covers losses that occur while cryptocurrencies are stored in a user’s private wallet.

Premiums: The cost of crypto insurance premiums varies depending on factors like the amount of coverage, the type of cryptocurrency held, the security measures in place, and the insurance provider. From what we hear in the market, premiums can range from a 1% for cold wallets up to 10% for hot wallets of the amount insured per year.

Limits and Deductibles: Policies may have limits on the maximum coverage amount and deductibles that the policyholder must pay before the insurance coverage kicks in.

Security Requirements: Insurers often require policyholders to follow strict security practices, such as using hardware wallets, employing multi-factor authentication (MFA), and regularly updating security measures.

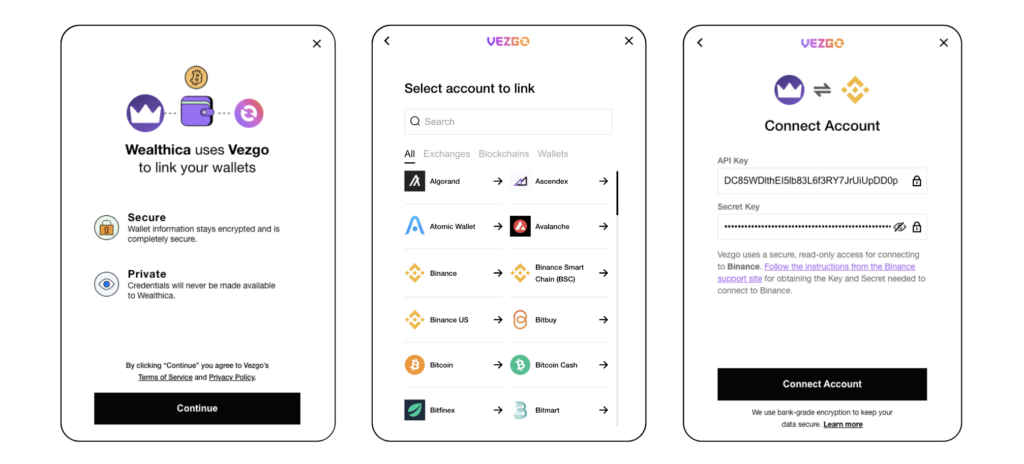

Claims Process: In the event of a loss, policyholders must follow a claims process, which usually involves providing evidence of the loss and cooperating with the insurer’s investigation. Vezgo works with crypto insurance companies to track wallets and exchange accounts at all time and automate claims.

Regulation: The crypto insurance industry is still evolving and may not be as heavily regulated as traditional insurance. Investors should carefully review policy terms and the financial stability of the insurance provider.

Exclusions: Policies may have exclusions, such as losses resulting from user negligence, unapproved third-party apps, or pre-existing vulnerabilities in the wallet or exchange.

Crypto insurance can provide a layer of protection for individual investors who are concerned about the security of their cryptocurrency holdings. However, it’s essential to thoroughly research insurance providers, understand policy terms and limitations, and assess whether the coverage aligns with your specific needs and risk tolerance.

Why is Crypto Insurance Necessary

If you’re wondering about the benefits of crypto insurance and are of two minds as to whether it’s necessary, here’s some food for thought:

1. Profitability in crypto investment

Despite the dynamics of a notoriously volatile cryptocurrency market, many investors are equally raking in the big bucks.

And looking on greedily are the equally busy hackers who keep devising new means to create and exploit potential security loopholes, swiftly turning the joys of unsuspecting investors to tears.

Given the cryptocurrency market’s vast capitalization, it’s no surprise that cybercriminals increasingly target this industry.

With every token you make in futures, day, high frequency, and range trading, cybercriminals are looking on remotely, probing your wallets for signs of weakness to pounce and loot.

But with crypto insurance, you can make sure that your investments are covered against hacks and thefts.

2. The inherent vulnerabilities of software and hardware wallets

Another reason you should consider cryptocurrency insurance is the weaknesses associated with soft wallets. Many investors hold their digital assets in software-based wallets accessed via an internet connection.

Although these wallets are convenient and easily integrated with several platforms, they’re highly vulnerable to cyber-attacks. Hackers can only reach you if you’re connected to the world wide web, and software wallets aren’t as secure as they may seem. Unless you’re using a hardware wallet, also known as cold wallet, you’re exposed to this risk.

Hardware wallets store your private keys safely, but even these devices aren’t 100% safe.

Last Words on Crypto Insurance

Blockchain technology, and cryptocurrencies, by extension, are built upon solid, nearly impenetrable security protocols.

However, these protocols aren’t 100% fool-proof, as they’re still susceptible to different forms of cyberattack. These vulnerabilities all combine to make cryptocurrencies a tricky asset to insure.

As a result, not many insurance companies today are willing to take on the risk of such a volatile asset class. But, there’s hope.

Many countries are slowly reaching accords with exchanges regarding regulation. The willingness of governments to provide legislative regulations for the blockchain industry will increase investment in cryptocurrency insurance.

However, this budding industry will only grow slowly, given crypto’s inherent risk factor and volatility.

Vezgo’s Contribution To A Safer Cryptocurrency Ecosystem

While investors still have their roles to play in ensuring their digital assets are safe, the heavier responsibility rests on the crypto exchanges, wallets, and crypto insurance providers.

This is where Vezgo comes in.

Crypto insurance providers can rely on Vezgo API to gather data about their client’s crypto holdings from all crypto accounts, including exchanges, wallets, and blockchains. This way, they can easily ascertain crypto ownership and track crypto movements.

Vezgo covers over 40 exchanges, 21 blockchains, and 250 wallets.

And as we speak, over 100 clients already entrust Vezgo with integral functionalities on their crypto insurance platforms, and they’ve never looked back.

You can be next by getting your Vezgo API key now.

Comments (1)

Integrate the Bitvavo API with Vezgo - Crypto APIsays:

8 March 2024 at 1:52 pm[…] of the use-cases of this API include portfolio trackers, tax and accounting software, crypto insurance platforms, crypto lending platforms, and so many […]