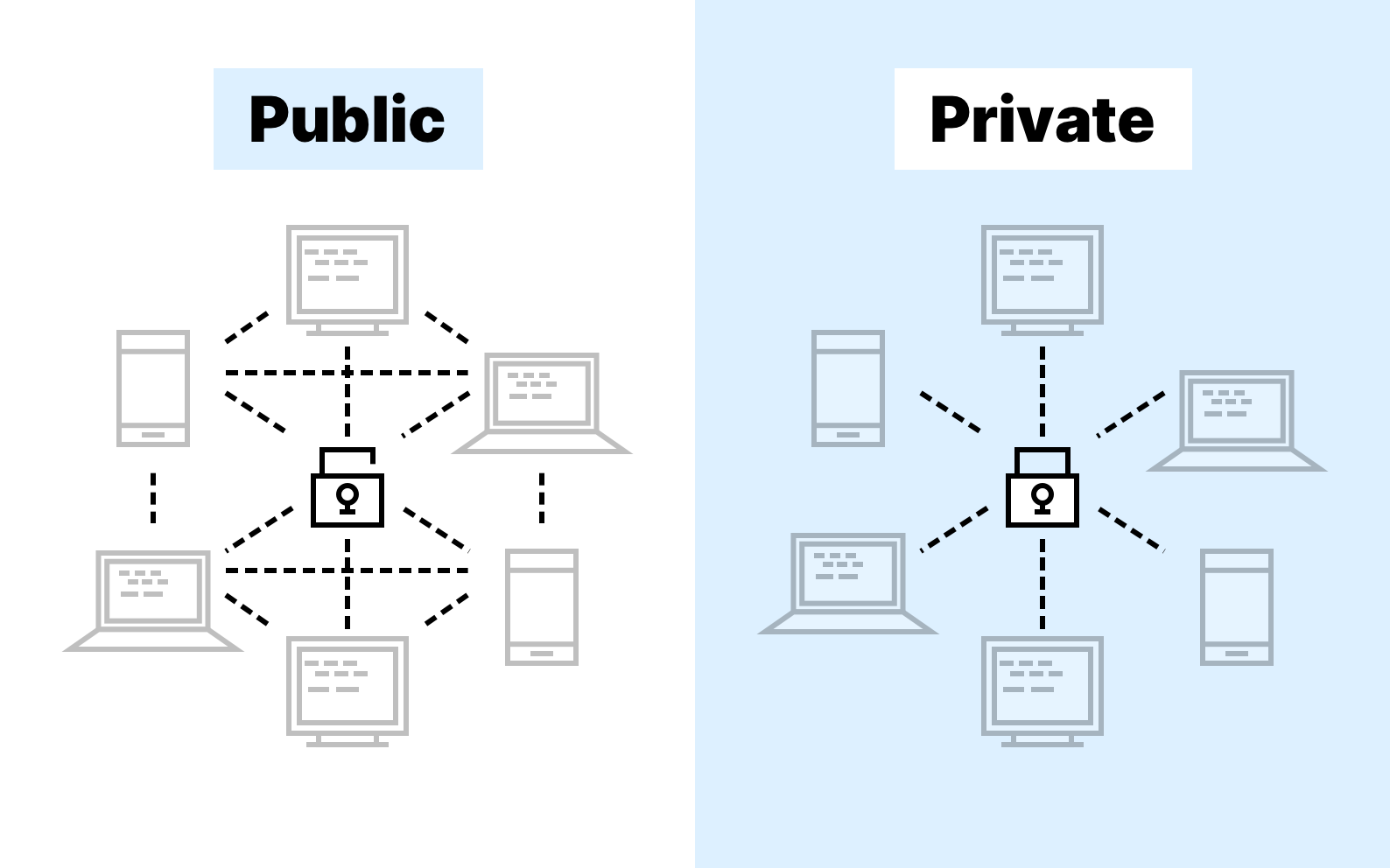

Within the realm of blockchain, there exists a fundamental distinction between public and private blockchains. This demarcation carries significant implications for businesses, governments, and individuals alike. We explore everything you need to know about public and private blockchains in this piece.

What is a Public Blockchain?

Public blockchains represent a revolutionary approach to decentralized transaction processing, exemplified by networks like Bitcoin and Ethereum. These blockchain networks are open to anyone with internet access, akin to a global public ledger accessible to all. Imagine a town square where everyone can observe and participate in transactions, with each transaction recorded transparently for all to see.

In the case of Bitcoin, every transaction is broadcast to the network, and validated by miners competing to solve complex mathematical puzzles. Once validated, the transaction is added to a block, forming a chain of blocks that constitute the immutable transaction history. This transparency and decentralization foster trust among participants, as no single entity has control over the network, ensuring the integrity and security of transactions.

Public blockchains offer unparalleled transparency and inclusivity, enabling a wide range of applications beyond cryptocurrency. These networks serve as platforms for decentralized applications (DApps), facilitating peer-to-peer transactions, smart contracts, and even decentralized finance (DeFi) protocols.

For example, Ethereum allows developers to build and deploy smart contracts, self-executing agreements encoded on the blockchain, enabling automated transactions and decentralized applications. The transparency and accessibility of public blockchains democratize access to financial services, empower individuals to control their digital assets, and foster innovation in various industries, from finance to healthcare and beyond. Let us take a deeper dive into the merits and demerits of public blockchain technology.

What are the Advantages of a Public Blockchain?

Here are some reasons why some organizations often opt for public blockchain technology.

1. Decentralization

Public blockchains operate in a decentralized manner, meaning no single entity or authority has control over the network. This decentralization fosters resilience and ensures that no central point of failure exists. Decentralization also promotes censorship resistance, as no single entity can arbitrarily censor transactions or control access to the network. For example, Bitcoin’s decentralized nature ensures that no single government or corporation can manipulate its supply or transaction history.

2. Transparency

Transparency is a core feature of public blockchains, where every transaction is recorded on a public ledger that is accessible to all participants. This transparency enhances trust among users, as they can independently verify transactions and track the flow of funds. For instance, anyone can inspect Bitcoin’s blockchain to verify the validity of transactions and the total supply of coins in circulation. This transparency also promotes accountability, as malicious actors are less likely to engage in fraudulent activities knowing that their actions are visible to the public.

3. Security

Public blockchains leverage cryptographic techniques and consensus mechanisms to ensure the security of transactions and the integrity of the network. For example, Bitcoin uses the Proof of Work (PoW) consensus mechanism, where miners compete to solve complex mathematical puzzles to validate transactions and add them to the blockchain. This process makes it computationally expensive for attackers to tamper with the transaction history, as they would need to control a majority of the network’s computing power. Additionally, the distributed nature of public blockchains makes them resistant to single points of failure and cyber attacks.

4. Accessibility

Public blockchains are open to anyone with an internet connection, allowing for inclusivity and participation from individuals and organizations worldwide. This accessibility democratizes access to financial services and digital assets, particularly in regions with limited banking infrastructure or government censorship. For example, individuals in countries with unstable financial systems or oppressive regimes can use cryptocurrencies like Bitcoin to store and transfer value without relying on traditional banks or government-controlled fiat currencies. Furthermore, public blockchains provide a platform for developers to build decentralized applications (DApps) and smart contracts, fostering innovation and creativity in the blockchain ecosystem.

What are the Disadvantages of a Public Blockchain?

While public blockchain holds much light, it also portends challenges that must be addressed to realize its full potential and foster mainstream adoption. Some of these are:

1. Scalability

Public blockchains face scalability challenges as the number of users and transactions increases. For example, Bitcoin’s blockchain has a limited throughput, processing only a handful of transactions per second. This limitation can lead to congestion and higher transaction fees during periods of high demand. Similarly, Ethereum’s blockchain has encountered scalability issues, particularly during periods of heavy usage such as initial coin offerings (ICOs) or decentralized finance (DeFi) transactions. Scalability solutions such as layer 2 scaling solutions and blockchain sharding are being developed to address these challenges, but implementation and adoption may take time.

2. Governance

Public blockchains often rely on decentralized governance models, where decisions regarding protocol upgrades, consensus mechanisms, and network parameters are made collectively by the community. While decentralization is a key principle of blockchain technology, it can also lead to governance challenges such as debates, disagreements, and forks within the community. For example, disagreements over Bitcoin’s block size limit led to the creation of Bitcoin Cash and subsequent forks. Similarly, Ethereum underwent a contentious hard fork in 2016 following the DAO hack, resulting in the creation of Ethereum Classic. These governance challenges can create uncertainty and volatility within the ecosystem, impacting user confidence and adoption.

3. Energy Consumption

Public blockchains that use Proof of Work (PoW) consensus mechanisms require significant computational resources to validate transactions and secure the network. This process consumes a substantial amount of energy, leading to concerns about environmental sustainability and carbon emissions. For example, Bitcoin mining consumes more energy than some small countries, raising questions about its long-term viability and environmental impact. While some blockchains are exploring alternative consensus mechanisms such as Proof of Stake (PoS) or delegated proof of stake (DPoS) to reduce energy consumption, PoW remains the dominant consensus mechanism for many public blockchains.

4. Privacy Concerns

While public blockchains offer transparency and immutability, they also raise privacy concerns as every transaction is recorded on a public ledger that is visible to all participants. While the pseudonymous nature of blockchain addresses provides a degree of privacy, it is still possible for sophisticated users to trace transactions and identify individuals or organizations involved. For example, blockchain analytics firms can analyze transaction patterns and link addresses to real-world identities, compromising user privacy. Additionally, the transparent nature of public blockchains may deter enterprises and individuals from conducting sensitive transactions or storing confidential information on-chain, limiting their utility in certain use cases such as healthcare or finance.

What are the Use Cases of a Public Blockchain?

Public blockchains have proven to be versatile platforms with a wide range of use cases spanning various industries. Here, we delve into several notable examples that showcase the transformative potential of public blockchain technology: Note that these examples represent just a fraction of the myriad use cases for public blockchain technology.

1. Cryptocurrency

Perhaps the most well-known application of public blockchain technology is cryptocurrency, digital or virtual currencies secured by cryptography and built on blockchain technology. Bitcoin, the first and most famous cryptocurrency, operates on a public blockchain, allowing users to transact peer-to-peer without the need for intermediaries like banks. Ethereum, another prominent public blockchain platform, enables the creation of smart contracts and decentralized applications (DApps), expanding the potential use cases beyond simple currency transactions.

2. Decentralized Finance (DeFi)

Decentralized finance, or DeFi, is an emerging sector leveraging public blockchain technology to recreate traditional financial services in a decentralized manner. DeFi platforms offer a wide range of financial services, including lending, borrowing, trading, and asset management, without the need for intermediaries like banks or brokers. For example, platforms like Uniswap and Compound operate on the Ethereum blockchain, allowing users to trade tokens and earn interest on deposited assets without relying on centralized exchanges or financial institutions.

3. Supply Chain Management

Public blockchains are increasingly being used to improve transparency and traceability in supply chain management. By recording every transaction on an immutable ledger, blockchain enables stakeholders to track the movement of goods and verify the authenticity of products throughout the supply chain. For instance, IBM’s Food Trust platform uses the Hyperledger Fabric blockchain to track food products from farm to table, reducing food fraud, improving food safety, and enhancing trust among consumers.

4. Voting and Governance

Public blockchains offer a transparent and tamper-proof platform for conducting elections and governance processes. By recording votes on a public ledger, blockchain can enhance the integrity and transparency of electoral processes, reducing the risk of fraud or manipulation. For example, the city of Zug in Switzerland conducted a blockchain-based voting trial in 2018, allowing residents to cast their votes on municipal matters using a smartphone app. Similarly, some political parties and organizations have explored blockchain-based voting systems to increase transparency and voter participation in elections.

5. Intellectual Property Management

Public blockchains can be used to manage and protect intellectual property rights, such as patents, copyrights, and trademarks. By timestamping and storing intellectual property records on a public blockchain, creators can establish proof of ownership and enforce their rights more effectively. For example, the Ethereum-based platform known as Verisart enables artists to create blockchain-based certificates of authenticity for their artworks, providing a secure and verifiable way to prove ownership and provenance.

6. Identity Verification

Public blockchains can serve as a secure and decentralized platform for identity verification and authentication. By storing identity credentials on a blockchain, individuals can control and share their personal information securely, reducing the risk of identity theft and fraud. For example, the Sovrin Network is a public blockchain-based platform that enables users to create and manage self-sovereign identities, allowing them to prove their identity without relying on centralized authorities or intermediaries.

What is a Private Blockchain?

In contrast to public blockchains, private blockchains operate within controlled environments, catering to specific organizations or consortia. These networks restrict access to authorized participants, akin to a private conference room where only invited members can engage in discussions. Unlike public blockchains where transactions are validated by a decentralized network of nodes, private blockchains rely on predetermined nodes or validators selected by the governing entity. This controlled validation process ensures greater privacy and control over sensitive data, making private blockchains suitable for enterprises and government entities seeking to streamline operations while maintaining confidentiality.

Private blockchains offer enhanced privacy, scalability, and governance tailored to the needs of enterprise applications. For instance, Hyperledger Fabric provides a framework for building permissioned blockchain networks, enabling businesses to collaborate on supply chain management, identity verification, and financial transactions securely.

These networks prioritize efficiency and compliance, offering features such as access controls, data encryption, and audit trails to meet regulatory requirements and industry standards. While private blockchains may lack the transparency and decentralization of their public counterparts, they offer a pragmatic approach to leveraging blockchain technology for enterprise use cases, empowering organizations to innovate and collaborate in a trusted environment. Let’s take a deeper dive into its advantages and disadvantages.

Advantages of Private Blockchain:

Here we discuss some of the merits of private blockchain technology.

1. Enhanced Privacy

Private blockchains offer greater privacy compared to their public counterparts, as access to the network is restricted to authorized participants. This heightened privacy is particularly beneficial for enterprises handling sensitive information or complying with regulatory requirements. For example, a private blockchain used by a healthcare consortium can ensure that only authorized healthcare providers have access to patient records, protecting patient privacy while facilitating secure data sharing and collaboration.

2. Scalability

Private blockchains can achieve higher transaction throughput and faster confirmation times compared to public blockchains. With fewer nodes to reach consensus, these networks can scale more efficiently to meet business needs. For instance, a private blockchain deployed within a supply chain ecosystem can process a large volume of transactions, such as inventory tracking and product authentication, without experiencing congestion or delays. This scalability enables enterprises to streamline operations and improve efficiency without sacrificing performance.

3. Control

Enterprises deploying private blockchains retain control over the network’s governance, operations, and data management. This control allows for tailored solutions that align with specific business requirements and compliance standards. For example, a financial institution can customize the consensus mechanism and access controls of a private blockchain to ensure regulatory compliance and data integrity. This level of control provides enterprises with greater flexibility and autonomy in managing their blockchain infrastructure and applications.

4. Efficiency

Private blockchains can streamline processes and reduce costs by eliminating intermediaries and automating workflows. Smart contracts, self-executing agreements encoded on the blockchain, enable automated transactions and enforce business logic. For example, a private blockchain used for trade finance can automate the execution of payment terms and shipping documentation, reducing manual errors and delays. These efficiency gains from private blockchains can lead to cost savings and operational improvements for enterprises across various industries.

Disadvantages of Private Blockchain

The following are some limitations of the private blockchain.

1. Centralization

Private blockchains are inherently more centralized than their public counterparts, as access and validation are controlled by a select group of participants. This centralized control may raise concerns regarding trust and security, particularly in industries where decentralization is valued. For example, a consortium of banks operating a private blockchain may face scrutiny over the concentration of power and potential conflicts of interest. Additionally, centralization can undermine the resilience and censorship resistance of the network, as it becomes vulnerable to collusion or coercion by a small group of actors.

2. Interoperability

Interoperability between private blockchains and external systems or other blockchains can pose challenges. Integrating legacy systems or communicating with external parties may require additional effort and resources. For example, a private blockchain used by a supply chain consortium may need to integrate with existing enterprise resource planning (ERP) systems and third-party logistics providers, necessitating complex data mapping and integration processes. This interoperability gap can hinder the seamless exchange of information and transactions between different systems, limiting the scalability and utility of private blockchains.

3. Security Risks

While private blockchains offer enhanced privacy, they may be vulnerable to insider threats or collusion among authorized participants. Ensuring robust security measures and access controls is paramount to mitigate these risks. For example, a private blockchain used for voting or elections may be susceptible to manipulation or fraud by insiders with malicious intent. Additionally, the centralized nature of private blockchains may make them a target for cyber attacks or unauthorized access attempts. Implementing strong authentication, encryption, and auditing mechanisms is essential to safeguard the integrity and confidentiality of data on private blockchains.

4. Cost and Complexity

Deploying and maintaining a private blockchain infrastructure can be costly and complex, requiring significant upfront investment in hardware, software, and personnel. For example, setting up nodes, configuring network parameters, and ensuring compliance with regulatory requirements can involve substantial time and resources. Additionally, ongoing maintenance, upgrades, and support services may incur recurring expenses for enterprises operating private blockchains. This cost and complexity barrier can deter smaller organizations or startups from adopting private blockchain solutions, limiting their accessibility and adoption.

Let’s Talk About Vezgo

We introduce you to Vezgo, the cutting-edge crypto API revolutionizing how developers access and aggregate users’ cryptocurrency data. With Vezgo’s unified API, developers can seamlessly retrieve and consolidate users’ cryptocurrency balances, tokens, and transaction history across a myriad of exchanges, wallets, and blockchains. Gone are the days of grappling with disparate data sources and complex integrations. Vezgo simplifies the process, offering a single point of access for all crypto-related data needs.

Vezgo’s API boasts support for both centralized and decentralized crypto data, ensuring developers have access to a comprehensive dataset regardless of the source. By delivering consistent data formatting and timely updates, Vezgo empowers developers to build robust applications with confidence, knowing they have access to accurate and up-to-date information. Whether retrieving position and balance data in native or fiat values, Vezgo’s user-friendly API makes it effortless to access crypto account information across multiple exchanges, blockchains, and wallets.

In addition to its prowess in accessing and aggregating cryptocurrency data, Vezgo offers a comprehensive solution for developers seeking to integrate non-fungible token (NFT) data into their products. Vezgo’s NFT API allows developers to effortlessly retrieve NFT data on more than six blockchain chains, including Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, and Cronos. This broad support streamlines the process of obtaining NFT information, automating the gathering of data from multiple blockchain protocols and organizing it for easy access and analysis. Whether building NFT marketplaces, gaming platforms, or digital collectibles applications, developers can leverage Vezgo’s NFT API to enrich their products with valuable NFT data seamlessly.

FAQs

These are answers to some of the most commonly asked questions about public and private blockchains.

Leave a Reply