Once hailed as the backbone of a decentralized future, blockchain technology faces a daunting adversary: scalability. As cryptocurrencies like Bitcoin and Ethereum grow in popularity, their networks buckle under the strain of millions of transactions. Enthusiasts and skeptics grapple with a pressing question: how can we maintain the integrity and security of these decentralized systems while accommodating an ever-increasing user base? This intricate dance to balance throughput, security, and decentralization forms the crux of the blockchain scalability challenge.

Despite innovative solutions like sharding, state channels, and rollups, the path to seamless scalability remains fraught with technical and philosophical challenges, demanding relentless innovation and collaboration within the blockchain community. This piece explores the issues around blockchain scalability, the achievements made so far, and other challenges ahead.

Why is Scalability Important?

Scalability in blockchain is more than a technical challenge; it’s the key to unlocking the technology’s full potential. Without it, the dream of a decentralized future remains just that—a dream. Imagine a world where cryptocurrencies handle everyday transactions as effortlessly as swiping a credit card. Envision decentralized applications (dApps) supporting millions of users without lag and global supply chains operating transparently and efficiently on the blockchain. These scenarios hinge on the ability of blockchain networks to scale effectively, managing high transaction volumes without sacrificing performance.

Scalability makes these visions a reality, enabling blockchain to move beyond niche use cases and revolutionize industries on a massive scale. It’s the gateway to widespread adoption, driving innovation and transforming how we interact, transact, and trust in the digital age. By overcoming scalability challenges, blockchain technology can support more complex and diverse applications, from decentralized finance (DeFi) platforms to secure voting systems, making the digital world more accessible, efficient, and secure for everyone.

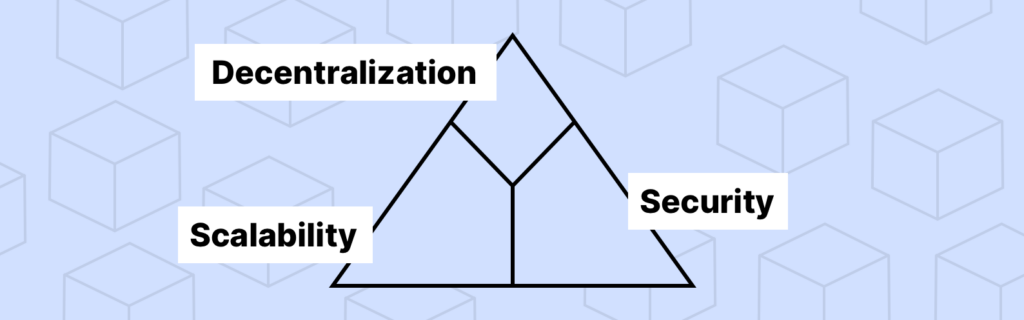

The Blockchain Scalability Trilemma

At the heart of blockchain’s struggle with scalability lies a concept developers and enthusiasts call the “scalability trilemma.” Coined by Ethereum’s co-founder Vitalik Buterin, the trilemma highlights the problematic balance among three crucial properties: decentralization, security, and scalability. Enhancing one often compromises the others, presenting a puzzle that has stymied even the brightest minds in the blockchain world. To truly grasp this trilemma, we must delve into each component and understand the intricate balance they require.

1. Decentralization

Decentralization represents the foundational ethos of blockchain technology. It ensures no single entity controls the network, distributing power across many nodes. This democratization fosters resilience, as no central point of failure exists. Decentralization underpins trust in the network, empowering participants to transact directly without intermediaries. However, decentralization poses significant scalability challenges. Each transaction must propagate through an extensive network of nodes, with each node validating and recording the transaction. This extensive duplication ensures security and transparency but drastically slows down transaction processing. For example, Bitcoin’s decentralized network validates transactions through a process called mining, which, while secure, limits the network to around seven transactions per second. Increasing transaction speed without sacrificing decentralization requires innovative approaches, yet many solutions risk centralizing control by requiring high resource commitments from fewer, more powerful nodes.

2. Security

Security in the blockchain is paramount, ensuring the integrity and immutability of transactions. Cryptographic techniques and consensus mechanisms like Proof of Work (PoW) and Proof of Stake (PoS) fortify this security. These systems make it exceedingly difficult for malicious actors to alter the blockchain, maintaining trust across the network.

Yet, security mechanisms often clash with scalability. PoW, for example, requires significant computational power to solve cryptographic puzzles, deliberately slowing down transaction processing to prevent attacks. This deliberate slowdown means that while the network remains secure, it cannot quickly handle high volumes of transactions. Transitioning to PoS, as seen in Ethereum 2.0, alleviates some computational burdens, but introducing new consensus mechanisms must be done carefully to avoid new vulnerabilities. Balancing robust security with the need for speed and capacity demands constant vigilance and innovation.

3. Scalability

Scalability is the ability of the blockchain to handle an increasing number of transactions per second. For blockchain technology to rival traditional payment systems like Visa, which processes thousands of transactions per second, it must drastically improve its throughput. However, enhancing scalability often conflicts with maintaining decentralization and security. Larger block sizes or faster block times can increase throughput, but these changes can strain network nodes, leading to centralization. Moreover, speeding up transaction processing can compromise the thorough validation processes critical for security. This intricate balance has led to various Layer 1 and Layer 2 solutions, such as sharding and state channels, which seek to offload transactions or process them in parallel without overwhelming the network. Each solution offers a piece of the puzzle, but maintaining this balance remains a dynamic and ongoing challenge.

Transaction Throughput: The Heart of Scalability

At the core of blockchain scalability lies transaction throughput, a crucial measure of how many transactions a network can process per second (TPS). Achieving high transaction throughput is essential for blockchain to compete with traditional financial systems and support various applications. However, increasing throughput is a complex task, requiring careful consideration of block size and time, significantly influencing blockchain networks’ performance and efficiency.

Block Size

Block size directly affects transaction throughput by determining how much data each block can hold. Larger blocks can accommodate more transactions, seemingly offering a straightforward path to higher throughput. However, this approach comes with trade-offs. Larger blocks require more storage and bandwidth, which can strain network nodes. Only nodes with significant resources can keep up as blocks grow, leading to centralization risks as fewer entities control more of the network. The infamous block size debate in Bitcoin, which led to the creation of Bitcoin Cash (BCH), highlighted these issues. Bitcoin Cash increased the block size to 8 MB to enhance throughput, but this decision sparked controversy over potential centralization and the resulting security implications.

Block Time

Block time, the interval between the creation of consecutive blocks, also plays a vital role in transaction throughput. Shorter block times mean new transactions get processed more quickly, increasing the overall TPS. Ethereum, for instance, has a block time of about 15 seconds compared to Bitcoin’s 10 minutes, allowing it to process more transactions in a given period. However, reducing block time isn’t a panacea. Faster block generation can lead to more frequent forks, where multiple blocks are created simultaneously, temporarily splitting the network. These forks need resolution, which can complicate consensus and potentially reduce security. Managing this balance between speed and network stability requires sophisticated mechanisms to ensure that shorter block times do not compromise the integrity and security of the blockchain.

Navigating the Trade-Offs

Balancing block size and block time to optimize transaction throughput involves navigating a series of trade-offs. Larger blocks and shorter times can boost throughput but risk centralization and security issues. Blockchain developers continuously experiment with and refine these parameters, seeking a sweet spot that enhances performance without undermining the network’s foundational principles. Subsequently, we explore Layer 2 solutions, like state channels and rollups, and Layer 1 innovations, like sharding, which are part of this ongoing effort, aimed to offload transactions or process them in parallel to reduce the burden on the main chain.

What are the Solutions to Blockchain Scalability?

Developers and researchers have devised various strategies to address the scalability challenge, categorized primarily into Layer 1 and Layer 2 solutions. Layer 1 solutions aim to optimize the base layer of the blockchain itself, while Layer 2 solutions build on top of the existing blockchain to enhance scalability without altering the underlying protocol. Both approaches play crucial roles in the ongoing effort to create a more efficient, scalable blockchain ecosystem.

A. Layer 1 Solutions: Optimizing the Base Layer

Layer 1 solutions focus on fundamental changes to the blockchain protocol to improve scalability. These solutions involve rethinking and redesigning core aspects of the blockchain to enhance transaction throughput and network efficiency.

1. Sharding

Sharding stands out as one of the most promising Layer 1 solutions. Borrowed from database management, sharding involves splitting the blockchain into smaller, more manageable pieces called shards. Each shard processes its transactions and smart contracts independently, allowing multiple shards to operate in parallel. This parallel processing significantly boosts transaction throughput. Ethereum 2.0, the major upgrade to the Ethereum network, incorporates sharding to address scalability. While sharding holds immense potential, it also challenges ensuring efficient communication between shards and maintaining network security.

2. Consensus Mechanism Improvements

Another critical Layer 1 strategy involves improving the consensus mechanisms that underpin blockchain security and transaction validation. Proof of Work (PoW), used by Bitcoin, is secure but notoriously resource-intensive and slow. Proof of Stake (PoS) offers a more scalable alternative by reducing computational requirements and enabling faster transaction processing. Ethereum’s transition to PoS with Ethereum 2.0 exemplifies this shift. PoS-based systems, such as Delegated Proof of Stake (DPoS) or Practical Byzantine Fault Tolerance (PBFT), can achieve higher throughput while maintaining security. These mechanisms, however, must carefully balance decentralization and security to avoid new vulnerabilities.

3. Block Size and Block Time Adjustments

Adjusting block size and time is straightforward to enhance Layer 1 scalability. Increasing block size allows more transactions per block, while reducing block time speeds up transaction processing. However, as discussed earlier, these adjustments come with trade-offs, such as increased storage requirements and potential centralization risks. Finding the optimal balance is crucial to ensuring these changes contribute to scalability without compromising the blockchain’s core principles.

B. Layer 2 Solutions: Building on Top of the Blockchain

Layer 2 solutions aim to enhance scalability by offloading transactions from the main blockchain, thereby reducing congestion and increasing throughput. These solutions operate on top of the existing blockchain, preserving its security and decentralization while improving performance.

1. State Channels

State channels, such as Bitcoin’s Lightning Network and Ethereum’s Raiden Network, allow participants to conduct multiple transactions off-chain. Only the final state of these transactions gets recorded on the blockchain, significantly reducing the load on the main chain. State channels are particularly effective for microtransactions and applications requiring high transaction speeds. However, they require continuous connectivity between participants and face liquidity and user adoption challenges. Ensuring user-friendly interfaces and robust liquidity mechanisms is key to the widespread

adoption of state channels. With a seamless user experience and reliable liquidity pools, state channels could revolutionize everyday microtransactions and interactions within decentralized applications (dApps).

2. Sidechains

Sidechains are independent blockchains that run parallel to the main chain, with their own consensus mechanisms and transaction processing rules. Transactions can move between the main and side chains, allowing for greater scalability. Projects like Liquid Network and Plasma exemplify the sidechain approach. Sidechains offer flexibility and scalability, enabling specialized use cases and applications. However, ensuring the security and integrity of sidechains relative to the main chain remains a critical concern. Effective cross-chain communication protocols and robust security measures are essential to the success of sidechains. If these mechanisms are not properly designed, they can become vectors for attacks or inconsistencies between the main chain and sidechains.

3. Rollups

Rollups, including Optimistic Rollups and ZK-Rollups, bundle multiple transactions into a single batch and submit it to the main chain. Optimistic Rollups assume transactions are valid but can be challenged, while ZK-Rollups use zero-knowledge proofs to ensure all transactions in a batch are valid before submission. This batching process drastically reduces the load on the main chain, as fewer transactions need direct verification. Rollups are gaining traction due to their ability to significantly increase transaction throughput without compromising security. For example, Optimistic Rollups rely on game-theoretical principles to ensure honesty among participants, while ZK-Rollups use cryptographic proofs to provide instant finality and security. Both rollups represent a major advancement in Layer 2 scalability solutions, offering a promising path forward for high-throughput, secure blockchain networks.

Examples of Blockchain Scalability in Action

Examining real-world implementations provides valuable insights into the impact of scalability solutions. Let’s delve into two prominent case studies: Ethereum’s transition to Ethereum 2.0 and the implementation of the Lightning Network on Bitcoin. Both illustrate how scalability solutions can transform blockchain networks, enhancing their capacity to handle increased demand and diverse use cases.

1. Ethereum 2.0: A Leap Towards Scalability

Ethereum, one of the most widely used blockchain platforms, faced significant scalability challenges as it grew. With its initial Proof of Work (PoW) consensus mechanism, Ethereum struggled to handle high transaction volumes, leading to congestion and high fees. The Ethereum community embarked on a monumental upgrade to address these issues: Ethereum 2.0.

Central to Ethereum 2.0’s scalability solution is sharding. By splitting the blockchain into multiple shards, Ethereum can process transactions in parallel, significantly boosting throughput. Each shard operates independently, handling its transactions and smart contracts, which reduces the load on any single part of the network. The Beacon Chain coordinates these shards, maintaining consensus and security across the network. This approach allows Ethereum to scale linearly with the number of shards, offering a scalable solution that grows with demand.

Ethereum 2.0 also transitions from PoW to Proof of Stake (PoS), a crucial move to enhance scalability and reduce energy consumption. PoS replaces the energy-intensive mining process with a system where validators, who hold and lock up Ethereum tokens (ETH), propose and validate new blocks. This shift not only speeds up transaction processing but also lowers the barrier to entry for validators, promoting greater decentralization. By reducing the computational burden, PoS allows Ethereum to handle more transactions per second, paving the way for a more scalable and sustainable network.

In addition to sharding and PoS, Ethereum 2.0 embraces Layer 2 solutions like rollups to enhance scalability. Rollups bundle multiple transactions into a single batch and submit them to the Ethereum main chain. This approach significantly reduces the data that needs on-chain verification, increasing throughput without compromising security. Optimistic Rollups and ZK-rollups are actively integrated into Ethereum’s ecosystem, enabling faster and cheaper transactions. By combining these Layer 1 and 2 solutions, Ethereum 2.0 offers a robust and scalable decentralized applications (dApps) platform.

2. Bitcoin’s Lightning Network: Scaling Transactions Off-Chain

Bitcoin, the pioneer of blockchain technology, also faces scalability issues. Its limited block size and 10-minute block time constrain transaction throughput, often resulting in high fees and slow confirmations during peak usage. The Lightning Network, a Layer 2 solution, emerged to address these challenges, enabling faster and cheaper Bitcoin transactions.

The Lightning Network uses state channels to facilitate off-chain transactions. Two parties can open a channel by committing a certain amount of Bitcoin to a multi-signature address. They can conduct numerous transactions instantly and with negligible fees within this channel. Only the final state of the channel, reflecting the net balance, gets recorded on the main Bitcoin blockchain when the channel closes. This approach significantly reduces on-chain transaction load, enhancing scalability and user experience.

What makes the Lightning Network truly powerful is its network of interconnected channels. Users can route payments through multiple channels, enabling transactions between parties who do not have a direct channel open between them. This interconnected web of channels allows for seamless and scalable micropayments across the Bitcoin network. By leveraging existing channels, the Lightning Network enhances liquidity and accessibility, making Bitcoin practical for everyday transactions and microtransactions.

The Lightning Network has shown promising results in real-world applications. For instance, Strike, a popular Bitcoin wallet application, uses the Lightning Network to enable instant, low-fee transactions. This has opened up new use cases for Bitcoin, such as remittances, where speed and cost efficiency are crucial. Moreover, merchants and service providers are increasingly adopting the Lightning Network to accept Bitcoin payments without worrying about high fees or long confirmation times. This widespread adoption demonstrates the potential of Layer 2 solutions to address scalability challenges effectively.

The Future of Blockchain Scalability

The future of blockchain scalability promises to be more dynamic and multifaceted than ever, with the emergence of Layer 3 solutions playing a crucial role. Layer 3 focuses on creating application-specific protocols atop Layer 1 and Layer 2 infrastructure, offering even more tailored scalability enhancements. These solutions can optimize performance for particular use cases, such as gaming or supply chain management, by providing specialized tools and frameworks. By building atop the existing layers, Layer 3 ensures that applications can scale efficiently while maintaining the security and decentralization provided by the lower layers.

Cross-chain interoperability stands out as another pivotal development in the scalability landscape. With the advent of projects like Polkadot and Cosmos, blockchains no longer operate in isolated silos. Instead, they can communicate and transact seamlessly across different networks. This interoperability allows for the efficient transfer of assets and data, creating a more cohesive and scalable blockchain ecosystem. By enabling diverse blockchains to work together, we harness their unique strengths, paving the way for innovative applications and services that can easily operate across multiple platforms.

Advances in cryptography, particularly zero-knowledge proofs (ZKPs) and other privacy-enhancing technologies, also drive the future of scalability. ZKPs allow transactions to be verified without revealing underlying data, providing privacy and efficiency. Zk-rollups, a specific application of ZKPs, aggregate thousands of transactions into a single proof, significantly boosting throughput while maintaining security. These cryptographic advancements improve scalability and enhance privacy and security, making blockchain technology more versatile and appealing for a wide range of applications. As these technologies mature, they will play an integral role in building scalable, secure, and user-friendly blockchain ecosystems that can support future demands.

Vezgo: The Crypto API

Vezgo stands as a beacon of efficiency in the realm of cryptocurrency integration. With its pioneering Crypto API, Vezgo offers developers a streamlined integration process that consolidates the functionalities of over 300 exchanges, blockchains, and wallets into a singular API key. This attribute of efficient integration is not merely advantageous but a testament to Vezgo’s commitment to simplifying the intricate process of crypto integration. By circumventing the traditionally exhaustive development efforts required to support various exchanges and wallets, the Vezgo API furnishes developers with a seamless solution for rapid integration.

In doing so, Vezgo not only preserves valuable time and resources but also alleviates the burdensome responsibilities placed upon development teams, allowing them to allocate their efforts toward other critical facets of application development. Moreover, the Vezgo API upholds a standardized approach to data formatting across all crypto connections, ensuring optimal data consistency and reliability within developers’ applications. This adherence to standardization engenders a heightened sense of trust and confidence among users, elevating the performance and usability of integrated trading platforms to unparalleled heights.

Furthermore, Vezgo’s prowess extends beyond mere efficiency; it is committed to staying abreast of the ever-evolving crypto landscape. The platform’s proactive approach involves continuous integration of new exchanges, wallets, and protocols, ensuring that developers and users remain apprised of the latest advancements within the crypto market. Such diligence empowers stakeholders to make informed decisions and maintain a competitive edge amidst the dynamic currents of the crypto industry.

In security, Vezgo stands unwavering and resolute in its dedication to safeguarding sensitive information. Employing AES-256 data encryption, the platform fortifies its defenses against potential threats, instilling confidence and assurance among developers and users alike. This comprehensive security infrastructure underscores Vezgo’s unwavering commitment to preserving the integrity of its users’ data and assets, engendering a climate of trust and reliability within the crypto integration landscape.

Finally, Vezgo distinguishes itself through its unwavering dedication to providing exemplary customer support. Its seasoned experts are poised to offer guidance and assistance to developers navigating the integration process, addressing technical queries, or seeking elucidation on platform functionalities. This steadfast commitment to customer satisfaction ensures that developers can harness Vezgo’s capabilities to their fullest potential, thereby maximizing the value proposition of their integrated trading applications.

FAQs

Here are answers to some of the most frequently asked questions on blockchain scalability:

Comments (1)

Integrate WalletConnect API With the Vezgo Crypto APIsays:

8 September 2024 at 4:27 pm[…] Scalability and performance are cornerstones of the WalletConnect API, designed to handle increasing volumes of transactions and user interactions without breaking a sweat. The API’s architecture efficiently supports high traffic loads, ensuring users experience smooth and responsive interactions with their decentralized applications, even during peak usage periods. This robust performance is crucial as the blockchain ecosystem expands and dApps attract more users. WalletConnect’s ability to scale seamlessly means that developers can confidently build applications, knowing their solutions will remain reliable and performant as they grow. This high level of scalability enhances the user experience and future-proofs applications against the challenges of rapid growth, making WalletConnect a dependable choice for developers aiming to deliver a high-quality, uninterrupted service in the evolving world of digital assets. […]